April 3, 2020

While economic activity remains at a standstill as most of the US stays home, the CARES Act is providing some short-term relief. However, there is still worry about whether the package is enough to avert steeper declines as investors are now looking for signs of COVID-19 treatments. Uncertainty and fear are the primary drivers of this market volatility.

These last few weeks couldn’t be a better example of how utterly impossible it is to attempt to time the market - trying to sell at the peak and buy at the bottom. No one knows when the tops and bottoms happen until they’ve already happened.

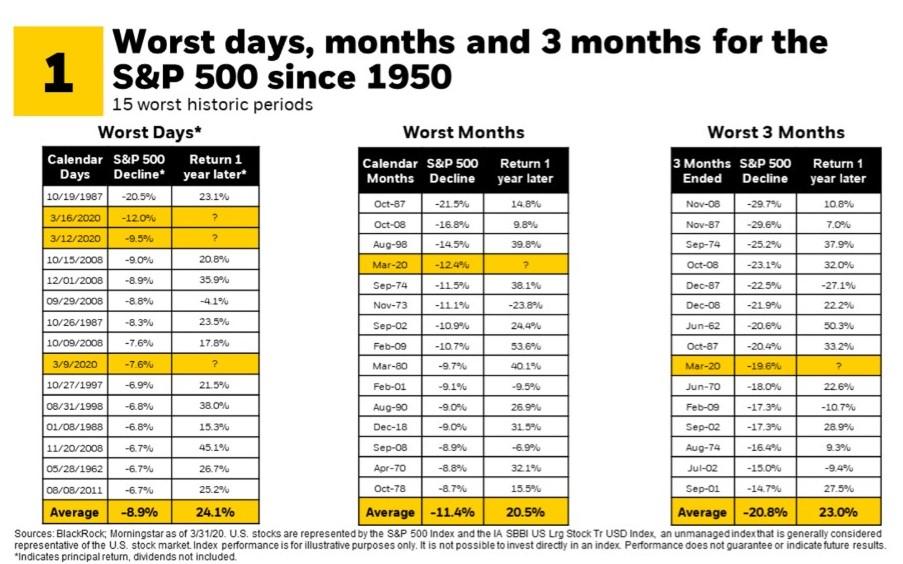

As we have said many times before, during times of volatility, we believe it is essential to keep investment perspectives long-term. For those investors that are financially able to stay invested, history shows that people do best when they take a long-term view. The chart below illustrates the 15 worst historic periods in the market, and the returns 1 year later.

Waiting until you’re sure the market contraction has ended and a recovery is on the way is not only impossible, but historically very costly. We don’t know when or what kind of recovery this will be. Every crisis and every recovery is different, and this crisis certainly looks very different from anything we’ve ever seen. But what we do know from history is that investing through crisis, contraction, recession, and recovery has been a successful strategy in the long-term, and that remains our stance as we provide guidance to our clients.