This year, pandemic-driven economic trends are expected to reverse, due to less severe inflationary catalysts and fading supply chain shortages. While we still expect above-average inflation to continue, current market expectations exceed our proprietary forecasts, which give us confidence as we begin to unwind some of our most inflation-sensitive hedges.

Historically, when the Fed begins its tightening cycle, volatility follows, so we have a heightened sense of caution. While we remain risk-on, we do scale down some sector bets and lean a bit more into quality. This is because we expect an exceedingly strong jobs market, real wage growth, robust consumer balance sheets, and corporate capital expenditure initiatives all to help boost economic activity and potentially drive continued relative strength in U.S. stocks. We believe companies that are asset heavy and more insulated from rising rates, with strong operating leverage, wide margins, and growing earnings stand to outperform – namely value-oriented, small cap, and energy stocks.

Regionally, we remain overweight to U.S. stocks and trim our exposure to international developed market stocks while incrementally adding to emerging market stocks.

Key Takeaways

Cautious optimism derived from strengthened U.S. labor markets

While we’ve trimmed our equity overweight and reduced active risk across the portfolios, we remain risk-on due to signs of a strengthened U.S. labor market: our payroll metric (calculated by taking U.S. wages, multiplying by hours worked, multiplying by number of employees, for all nonfarm private payrolls) has increased 12% since February 2021.

Strong jobs and wages generally boost economic activity, but still, we are cautious due to higher jobless claims in January (these claims could be driven by spiking covid cases or seasonal labor patterns). We will continue to monitor for early cracks to determine whether this jobless rate is anything that will impact the market long-term.

Volatility could be due to forthcoming rate hikes by Feds

Based on the strengthened job data and a steady inflation rate (two conditions for rate hikes) we anticipate that increased interest rates will be forthcoming in 2022—but the question remains when. The Fed previously mandated that rates would only increase when:

- Labor market conditions reach “maximum employment” and

- Inflation has risen to 2% and is on track to moderately exceed 2% for some time.

Given the outcome of January’s Federal Open Market Committee (FOMC) meeting, it appears Powell has already ticked off both boxes of his dual mandate. The good news is that rates are rising because the economy is strengthening.

We see the Fed tightening up policy in order to prepare for increases, withdrawing monetary support from a stronger, boosted economy that no longer needs stimulus. The increases are projected to be substantial, with the overnight interest rate making a jump—the average for 2022 has increased .29% to .81%.

When these Fed tightening cycles occur, volatility tends to follow, so we remain cautious as we await the outcomes of the next three FOMC meetings.

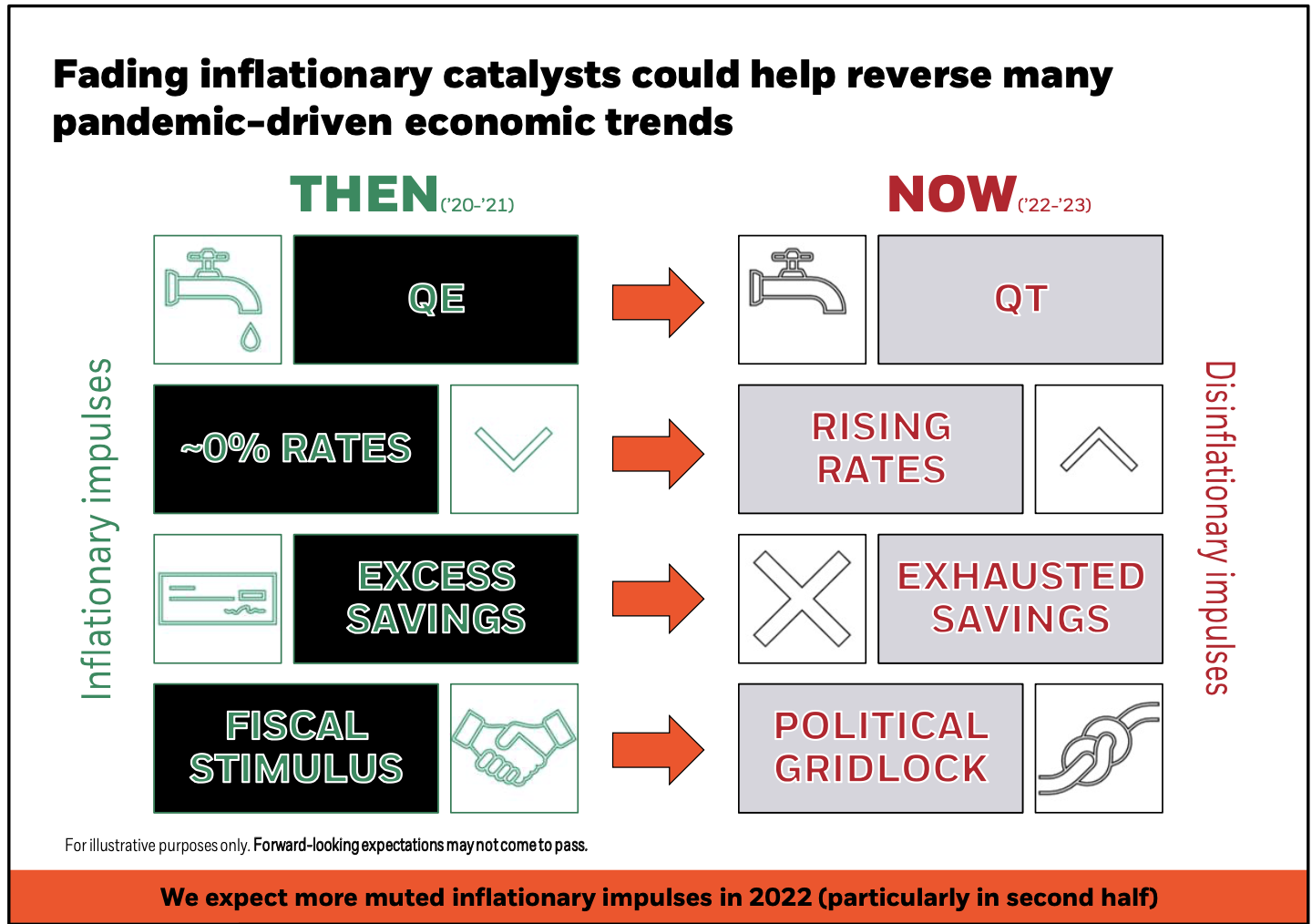

Fading inflationary catalysts could help reverse many pandemic-driven economic trends

The inflationary pandemic policy that served as a safety net for both U.S. consumers and producers is being removed as the economy prepares to bounce back, meaning the following inflationary catalysts are fading.

- QE - The Fed is shifting from quantitative easing (QE) to quantitative tightening (QT) in the coming quarters, pulling back on the stimulus efforts.

- Low interest rates - rates are rising and the market has been quick to reprice tightening expectations ahead of the Fed’s hawkish pivot. Treasury yields are up sharply across the board over the past month. The short-end has surged because of a sharp pulling forward of policy rate hikes, while we see the 10-year yield being driven more by a resurgence of the term premium.

- Excess savings - The $6T in savings for US consumers has diminished to closer to $2T, as pent-up demand for goods and services has been released.

- Stimulus - Fiscal stimulus is being halted as self-sustaining momentum builds, and inflationary pressures have reached Capitol Hill, disrupting the administration’s plans to pass its Build Back Better Bill.

Supply-chain disruptions are easing

In 2021, we saw many inflationary pressures and now many of those are dissipating. As a result, “transitory,” or non-permanent elements of inflation are improving, such as the supply chain issues that have been present throughout the pandemic.

A driver of this transitory inflation has been the supply chains. For the first time in recent history, supply has failed to keep up with demand, which is in contrast to what we have seen for the past 30 years. Given the strength of the economic restart, we expect supply to gradually rise.

One of the most visible examples of supply chain issues has been the shortage of microchips required for the production of automobiles, personal computers, smartphones, televisions, refrigerators, washing machines and more. As a result, car inventories plummeted in 2020-21, but we are now seeing chip inventories increase to ~1.7x what they were before the pandemic, an indicator that car production should be ramping up again soon.

Other drivers of inflation likely to remain

While goods inflation is projected to start leveling out, stickier components of inflation are expected to remain.

Housing is a prime example of these stickier components. Supply is historically low, so home prices are surging (in December, there was the equivalent to a 20% annualized growth rate; and the current housing supply of 2.4 months is less than half of the 20 year average of 5.6 months). Rent price trends also increased more than 20% year over year in December for one-bedroom apartments. Similarly, annual rent growth is expected to rise in every major U.S. housing market this year.

While headline CPI inflation is not expected to grow greater than 6% over the medium term, we do think it is possible that inflation will settle in at a higher level than the pre-pandemic era.

Getting creative in Fixed Income sleeve with addition of convertibles

You may be aware that we have been getting creative over the past two years with our fixed income sleeve. Some recent trades include exposure to fallen angel bonds and broad based commodities.

Now we are introducing convertible bonds for additional diversification and return potential, particularly in portfolios that hold a significant allocation to bonds.

Convertibles are neither stock or bond, so they can offer the best of both worlds—an attractive combination of return potential relative to stocks, with considerably less downside risk given their bond-like characteristics. From a sector perspective, there is heavy exposure to promising high-growth technology companies, an exposure we like as a complement to the bond portion of our portfolio.

In rising rate environments, stocks tend to outperform bonds, so we are particularly intrigued about convertible bonds at this time. Since a convertible bond’s price is influenced by the value of its underlying equity, its price is generally less influenced by interest rates in these environments than other fixed income securities.

Preference for U.S. stocks remains, with minor regional adjustments

We continue to have a preference for developed markets over emerging markets, specifically U.S. stocks and developed international stocks based on resilient fundamentals and corporate earnings strength.

Outside of the U.S., we’ve moderately reduced exposure to international developed market stocks. Eurozone’s manufacturing weakness and overall vulnerability to oil price pressures (as a heavy net importer of energy) can likely weigh on economic activity and earnings.

On the other hand, in the emerging markets, we’ve modestly increased exposure, based on marginally improving analyst estimate revisions and China’s policy commitment to targeted easing and steady growth. Even so, we remain meaningfully underweight due to a still challenging macroeconomic backdrop of rising rates, elevated inflation, and Covid disruptions.

Risk appetite continues to be impacted by pandemic ups and downs

We expect the Omicron economic impact (reduction of consumer’s spending and mobility) to be temporary and short-lived. While cases have reached an all-time high in the US, spiking above the 1M mark and about a 790k rolling average in the final weeks of January 2022, hospitalizations and even deaths are not maintaining that rate.

Omicron being a milder strain of Covid, combined with higher vaccination and “boosting” rates, has led to less deaths: The number of deaths (~10) per 1 million people has been cut in half since a year ago.

Even with this good news and newer strain BA.2 appearing to trend on the less lethal side, the risk remains that another strain with more damaging traits will emerge (for example, one with both a higher rate of contagiousness and lethality).

That said, the overall outlook looks brighter, thanks to the effects of vaccines, reduced severity, and acquired immunity. These factors are all helping us get a step closer to normalcy.

Trade Details*

*Tactical changes are dependent upon your investment strategy and risk tolerance.

- Maintain a pro-risk view but marginally reduce both our overweight to equities and our title to cyclical assets, continuing a theme from earlier trades to nudge portfolio risk closer to benchmark amidst increased uncertainty.

- Began to proactively pull back on some successful early-stage inflation trades and hedges; an anticipatory move given stretched valuations for inflation protection, easing supply-chain constraints, and a more hawkish Fed.

- Increase net exposure to nominal U.S. treasuries and continue rotation out of credit, seeing both:

- a tactical opportunity to capitalize on the recent selloff in rates, and

- a strategic opportunity to improve the efficacy of our fixed income sleeves as a portfolio diversifier

- Introduce convertible bonds across our fixed income-heavy portfolios, providing exposure to a hybrid source of both:

- growth with the upside potential of equities (and an attractive embedded tilt to promising technology companies), and

- income with the downside resiliency of bonds and less sensitivity to rising rates